Alex Corporation reports the following components, providing a comprehensive overview of its financial health. This report analyzes key financial metrics, revenue streams, expenses, profitability, liquidity, solvency, capital structure, and historical and projected performance, offering insights into the company’s financial strengths and areas for improvement.

Our analysis unveils trends and patterns in Alex Corporation’s financial components, enabling informed decision-making and strategic planning. By delving into the company’s financial performance, we aim to empower stakeholders with the knowledge necessary to assess its financial stability and growth potential.

Overview of Alex Corporation’s Financial Components

Alex Corporation reports key financial components that provide insights into its financial health. These include revenue, expenses, profit margin, liquidity ratios, solvency metrics, capital structure, financial ratios, and historical financial performance. Analysis of these components helps assess the company’s financial strength, profitability, and overall performance.

Revenue Analysis

Alex Corporation generates revenue from multiple sources. Primary revenue streams include sales of products, services, or subscriptions. Revenue analysis involves examining the different sources of income and their contribution to the company’s overall performance. It helps identify growth opportunities and areas for improvement in revenue generation.

Expense Breakdown

Alex Corporation’s expenses can be categorized into various types, such as cost of goods sold, operating expenses, administrative expenses, and research and development expenses. Expense breakdown involves creating a table outlining these expenses and analyzing their impact on the company’s profitability.

It helps identify areas for cost optimization or expense reduction strategies.

Profitability Assessment

Profitability assessment involves calculating and explaining Alex Corporation’s profit margin and profitability ratios. Profit margin measures the company’s profitability relative to its revenue, while profitability ratios provide insights into the efficiency of its operations. Analysis of these metrics helps identify factors influencing profitability and potential strategies to enhance it.

Liquidity and Solvency Evaluation

Liquidity and solvency evaluation involves analyzing Alex Corporation’s liquidity ratios and solvency metrics. Liquidity ratios assess the company’s ability to meet short-term obligations, while solvency metrics evaluate its long-term financial stability. Analysis of these metrics helps identify potential risks or areas for improvement in liquidity and solvency.

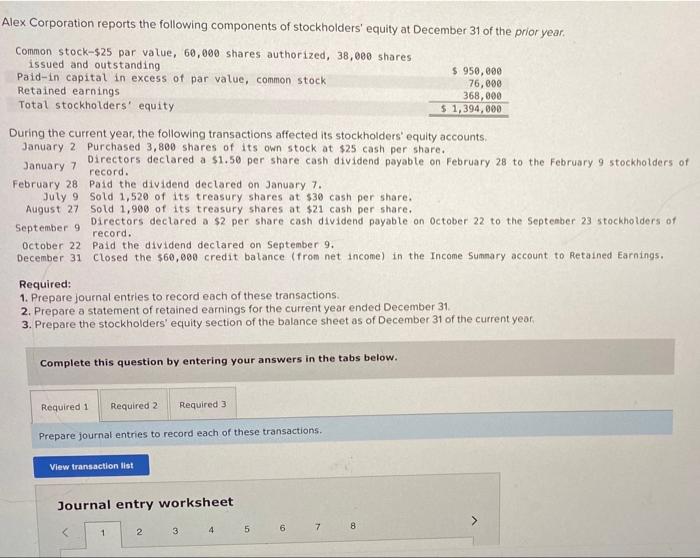

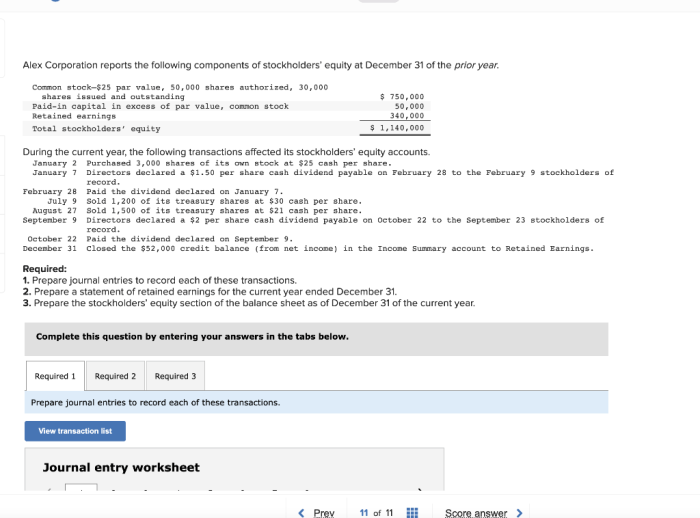

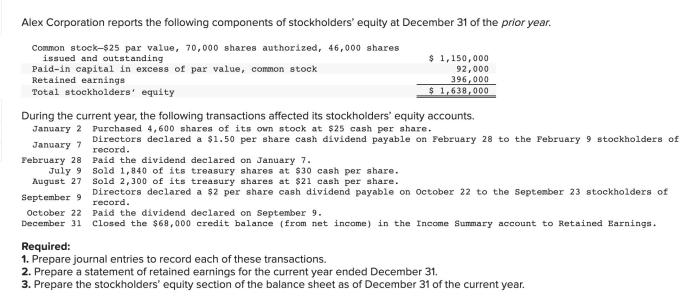

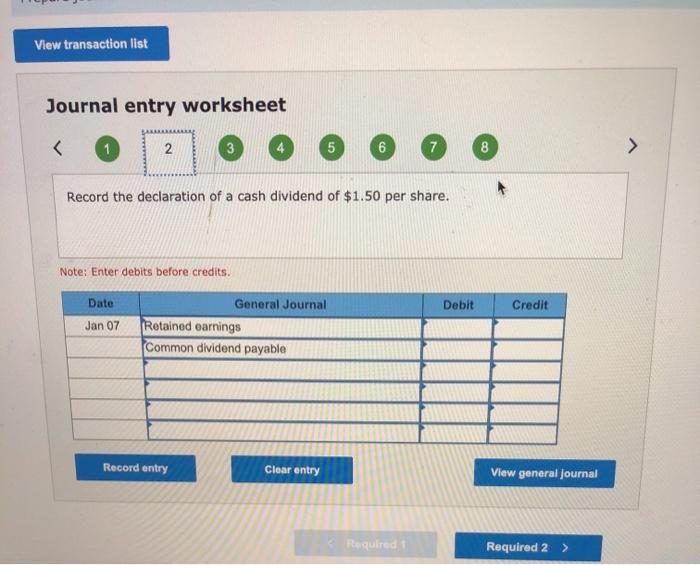

Capital Structure and Debt Analysis: Alex Corporation Reports The Following Components

Alex Corporation’s capital structure and debt profile provide insights into the mix of equity and debt financing used by the company. Debt analysis involves calculating and analyzing the company’s debt-to-equity ratio and other relevant debt metrics. This helps assess the company’s financial leverage and its ability to manage its debt obligations.

Financial Ratios and Benchmarking

Financial ratios provide a standardized way to compare Alex Corporation’s financial performance with industry peers or competitors. Benchmarking involves calculating key financial ratios, such as gross profit margin, return on assets, and debt-to-equity ratio, and comparing them to industry averages or similar companies.

This helps identify areas where the company’s financial performance may need improvement.

Historical and Projected Financial Performance

Historical financial performance analysis involves summarizing Alex Corporation’s financial performance over the past several years. Projected financial performance involves discussing the company’s expected financial performance based on available data or analysts’ estimates. This analysis helps identify trends and patterns in the company’s financial performance and provides insights into its future prospects.

Financial Reporting and Disclosure

Financial reporting and disclosure analysis involves evaluating Alex Corporation’s financial reporting practices and disclosure policies. This includes assessing the transparency and completeness of the company’s financial statements and identifying areas where the company’s financial reporting could be improved.

Impact of Economic Conditions on Financial Performance

Analyzing the impact of economic conditions on Alex Corporation’s financial performance involves assessing how macroeconomic factors and industry trends affect the company’s financial components. This analysis helps identify potential risks or opportunities arising from the economic environment and provides insights into the company’s resilience to external factors.

Query Resolution

What are the key financial components reported by Alex Corporation?

Alex Corporation reports revenue, expenses, profitability, liquidity, solvency, capital structure, and historical and projected performance.

How does this report help assess Alex Corporation’s financial health?

This report provides a comprehensive analysis of Alex Corporation’s financial components, enabling stakeholders to evaluate its financial stability, performance, and growth potential.

What are the major categories of expenses incurred by Alex Corporation?

Alex Corporation’s expenses are categorized into various types, including cost of goods sold, operating expenses, administrative expenses, and other expenses.